Mnm Asset Management: Explained

-

Table of Contents

- MnM Asset Management: A Comprehensive Guide to Maximizing Returns

- Understanding Asset Management

- Key Components of Asset Management

- The Role of MnM Asset Management

- Strategies for Success in Asset Management

- Case Studies and Examples

- Measuring the Impact of Asset Management

- Performance Metrics

- Challenges Facing Asset Managers

- Conclusion: Key Takeaways from MnM Asset Management

- Enhance Your Health with ETChem’s Protein Products

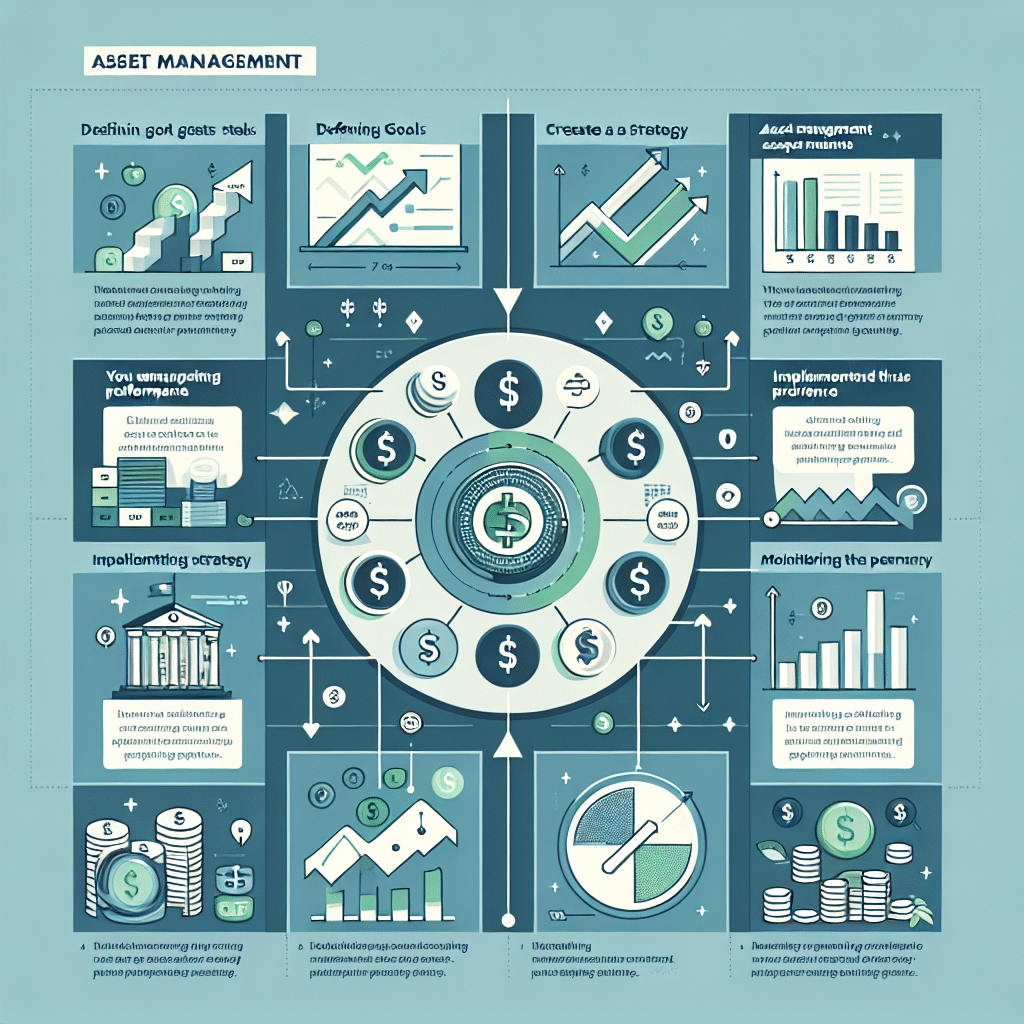

MnM Asset Management: A Comprehensive Guide to Maximizing Returns

Asset management is a critical component of the financial sector, providing the framework for individuals and institutions to systematically grow their wealth through strategic investment decisions. MnM Asset Management, although a fictional entity for the purpose of this article, represents the type of firm that specializes in managing assets to achieve specific financial goals. In this comprehensive guide, we will explore the intricacies of asset management, using MnM as a model to illustrate best practices, strategies, and the value such firms can bring to investors.

Understanding Asset Management

Asset management is the process of developing, operating, maintaining, and selling assets in a cost-effective manner. Most commonly, it refers to the management of investment funds, where the goal is to increase the value of the client’s holdings through careful investment strategies.

Key Components of Asset Management

- Portfolio Diversification

- Risk Assessment and Management

- Asset Allocation

- Performance Monitoring

- Regulatory Compliance

The Role of MnM Asset Management

MnM Asset Management plays a pivotal role in guiding investors through the complex landscape of investing. The firm’s responsibilities include:

- Conducting thorough market research

- Developing personalized investment strategies

- Continuous monitoring and rebalancing of portfolios

- Providing transparent reporting to clients

- Ensuring adherence to ethical and legal standards

Strategies for Success in Asset Management

Successful asset management firms like MnM employ a variety of strategies to maximize client returns while minimizing risks. These strategies often include:

- Active vs. Passive Management

- Value vs. Growth Investing

- Global Diversification

- Alternative Investments

- Environmental, Social, and Governance (ESG) Criteria

Case Studies and Examples

Let’s consider a case study where MnM Asset Management helped a client achieve their financial goals:

Case Study: Retirement Planning Success

John, a 50-year-old professional, approached MnM with the goal of retiring by the age of 65. MnM developed a diversified portfolio for John, focusing on a mix of equities, bonds, and alternative investments. By employing a dynamic asset allocation strategy, MnM was able to adjust John’s portfolio in response to market changes, ultimately providing him with a substantial nest egg that allowed him to retire comfortably at 63.

Measuring the Impact of Asset Management

The success of an asset management firm is often measured by its ability to outperform benchmarks and deliver competitive returns. Statistics such as annualized returns, alpha generation, and Sharpe ratios are commonly used to gauge performance.

Performance Metrics

- Annualized Returns

- Alpha Generation

- Sharpe Ratio

- Beta Analysis

- Expense Ratios

Challenges Facing Asset Managers

Asset management firms like MnM face a range of challenges, including:

- Market Volatility

- Regulatory Changes

- Technological Disruptions

- Client Retention

- Competition from Robo-Advisors

Despite these challenges, firms that adapt and innovate continue to thrive in the ever-evolving financial landscape.

Conclusion: Key Takeaways from MnM Asset Management

In conclusion, MnM Asset Management exemplifies the principles of effective asset management. By prioritizing client goals, employing strategic investment practices, and adapting to market conditions, asset management firms can significantly contribute to wealth creation. The key takeaways from this guide include the importance of diversification, risk management, performance measurement, and staying abreast of industry challenges.

Enhance Your Health with ETChem’s Protein Products

After understanding the importance of asset management in financial health, it’s equally important to consider your physical health. ETChem’s protein products offer a range of high-quality collagen supplements that can support your overall well-being. Whether you’re looking to improve your skin, strengthen your joints, or boost your nutrition, ETChem has a solution for you.

About ETChem:

ETChem, a reputable Chinese Collagen factory manufacturer and supplier, is renowned for producing, stocking, exporting, and delivering the highest quality collagens. They include marine collagen, fish collagen, bovine collagen, chicken collagen, type I collagen, type II collagen and type III collagen etc. Their offerings, characterized by a neutral taste, instant solubility attributes, cater to a diverse range of industries. They serve nutraceutical, pharmaceutical, cosmeceutical, veterinary, as well as food and beverage finished product distributors, traders, and manufacturers across Europe, USA, Canada, Australia, Thailand, Japan, Korea, Brazil, and Chile, among others.

ETChem specialization includes exporting and delivering tailor-made collagen powder and finished collagen nutritional supplements. Their extensive product range covers sectors like Food and Beverage, Sports Nutrition, Weight Management, Dietary Supplements, Health and Wellness Products, ensuring comprehensive solutions to meet all your protein needs.

As a trusted company by leading global food and beverage brands and Fortune 500 companies, ETChem reinforces China’s reputation in the global arena. For more information or to sample their products, please contact them and email karen(at)et-chem.com today.