Sugar, Salt, Fat Taxes: Evaluating Their Effects

-

Table of Contents

- Sugar, Salt, Fat Taxes: Evaluating Their Impact on Public Health

- The Rationale Behind Sugar, Salt, and Fat Taxes

- Case Studies: The Global Landscape of Food Taxes

- Impact on Consumer Behavior

- Health Outcomes: Do Food Taxes Lead to Better Health?

- Economic Considerations

- Conclusion: Weighing the Pros and Cons

- Enhance Your Diet with ETChem’s Protein Products

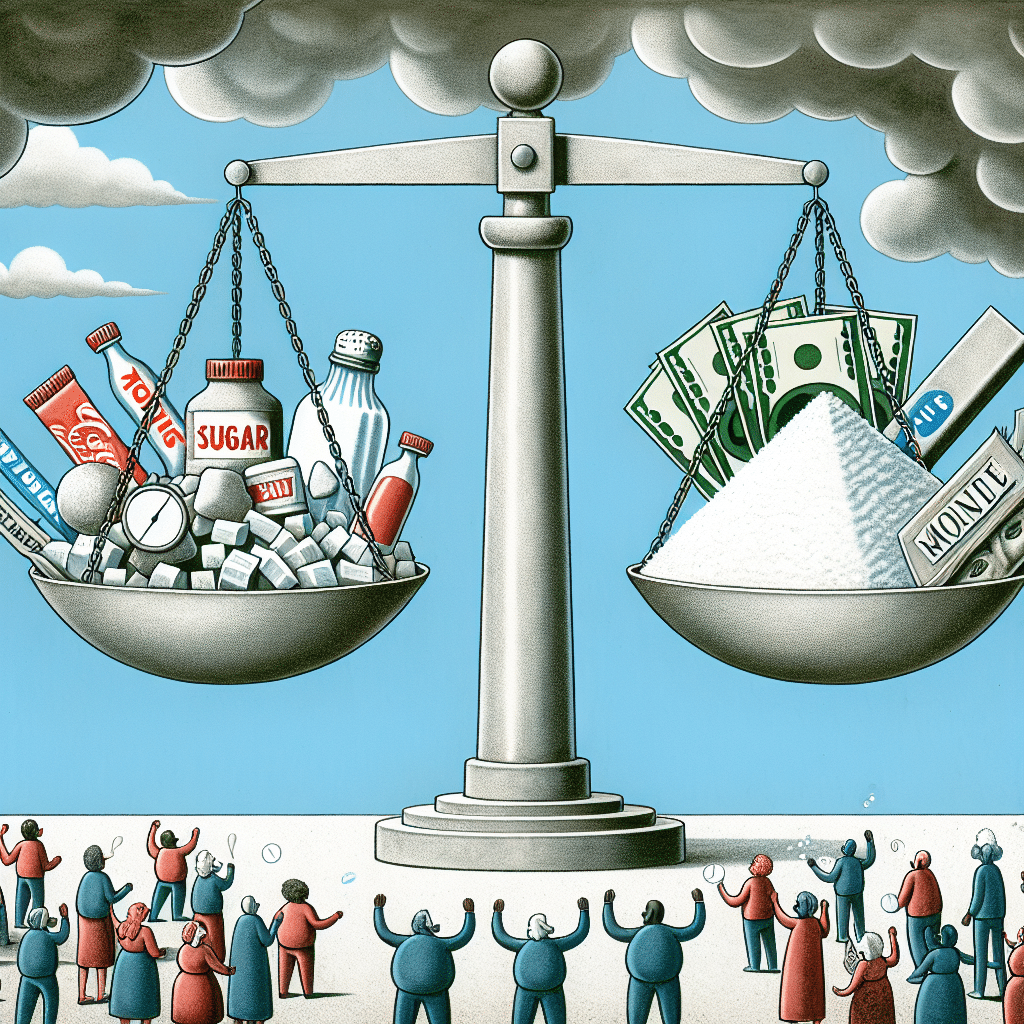

Sugar, Salt, Fat Taxes: Evaluating Their Impact on Public Health

In recent years, governments around the world have been grappling with the growing public health crisis of obesity and chronic diseases such as diabetes, heart disease, and certain cancers. One policy intervention that has gained traction is the implementation of taxes on unhealthy food components like sugar, salt, and fat. These so-called “sin taxes” aim to reduce consumption of these ingredients by making products that contain high levels of them more expensive. This article delves into the effects of sugar, salt, and fat taxes on consumer behavior, health outcomes, and the economy, supported by relevant examples, case studies, and statistics.

The Rationale Behind Sugar, Salt, and Fat Taxes

The primary goal of taxing sugar, salt, and fat is to improve public health by discouraging the consumption of unhealthy foods and beverages. The logic is straightforward: by increasing the cost of these items, consumers will be less likely to purchase them, leading to a decrease in intake and, consequently, a reduction in the incidence of diet-related diseases.

- Obesity and related diseases are on the rise globally, creating a significant burden on healthcare systems.

- Consumption of excessive sugar, salt, and fat is linked to various health issues, including heart disease, hypertension, and type 2 diabetes.

- Taxes on these ingredients can also encourage manufacturers to reformulate their products to be healthier.

Case Studies: The Global Landscape of Food Taxes

Different countries have adopted various approaches to taxing unhealthy food components, with mixed results. Here are a few notable examples:

- Mexico’s Sugar Tax: In 2014, Mexico implemented a tax on sugary drinks. Research has shown a decrease in the purchase of these beverages, with a more significant reduction among lower-income households.

- Hungary’s Public Health Product Tax: Hungary introduced a tax on products with high sugar, salt, and fat content in 2011. The tax led to a decrease in consumption of taxed items and prompted some manufacturers to change their recipes.

- The UK’s Soft Drinks Industry Levy: The UK’s approach targets manufacturers, charging them based on the sugar content of their drinks. It has resulted in significant reformulation of products to reduce sugar levels.

Impact on Consumer Behavior

One of the critical questions surrounding these taxes is whether they effectively change consumer behavior. Studies have shown that price increases can lead to reduced consumption of unhealthy products. However, the extent of this change varies depending on several factors:

- The size of the tax and resulting price increase.

- Consumer income levels and price sensitivity.

- Availability of healthier, affordable alternatives.

- Public awareness and understanding of the health issues associated with sugar, salt, and fat.

Health Outcomes: Do Food Taxes Lead to Better Health?

While changing consumer behavior is one thing, the ultimate goal of these taxes is to improve public health. Research indicates that taxes on sugar, salt, and fat can lead to modest reductions in the incidence of obesity and related diseases. However, the impact on public health is often long-term and can be difficult to measure in the short run.

Economic Considerations

Beyond health outcomes, it’s essential to consider the economic effects of food taxes. Critics argue that these taxes can be regressive, disproportionately affecting lower-income populations. On the other hand, supporters point out that the revenue generated from these taxes can be used to fund public health initiatives, potentially offsetting any regressive impact.

- Revenue generation for public health programs.

- Potential job losses in industries affected by decreased demand for taxed products.

- The balance between government intervention and personal responsibility.

Conclusion: Weighing the Pros and Cons

In conclusion, sugar, salt, and fat taxes are a contentious but potentially effective tool in the fight against diet-related diseases. While they can lead to positive changes in consumer behavior and health outcomes, their implementation must be carefully considered to avoid unintended economic consequences and ensure fairness. As more countries experiment with these taxes, it will be crucial to monitor their long-term effects on public health and the economy.

Enhance Your Diet with ETChem’s Protein Products

While reducing sugar, salt, and fat is essential for a healthier lifestyle, it’s equally important to focus on the quality of the protein in your diet. ETChem’s protein products offer a range of high-quality collagen supplements that can complement your nutritional needs. Whether you’re looking to improve your skin health, joint function, or overall wellness, ETChem provides a variety of protein solutions to support your goals.

About ETChem:

ETChem, a reputable Chinese Collagen factory manufacturer and supplier, is renowned for producing, stocking, exporting, and delivering the highest quality collagens. They include marine collagen, fish collagen, bovine collagen, chicken collagen, type I collagen, type II collagen and type III collagen etc. Their offerings, characterized by a neutral taste, instant solubility attributes, cater to a diverse range of industries. They serve nutraceutical, pharmaceutical, cosmeceutical, veterinary, as well as food and beverage finished product distributors, traders, and manufacturers across Europe, USA, Canada, Australia, Thailand, Japan, Korea, Brazil, and Chile, among others.

ETChem specialization includes exporting and delivering tailor-made collagen powder and finished collagen nutritional supplements. Their extensive product range covers sectors like Food and Beverage, Sports Nutrition, Weight Management, Dietary Supplements, Health and Wellness Products, ensuring comprehensive solutions to meet all your protein needs.

As a trusted company by leading global food and beverage brands and Fortune 500 companies, ETChem reinforces China’s reputation in the global arena. For more information or to sample their products, please contact them and email karen(at)et-chem.com today.